:max_bytes(150000):strip_icc()/portfolio-variance.asp-Final-a5efd061d3ff4a28a72b63b2b0ffc0f9.png)

Portfolio Variance: Definition, Formula, Calculation, and Example

Portfolio variance is the measurement of how the actual returns of a group of securities making up a portfolio fluctuate.

Portfolio Variance Formula (example) How to Calculate Portfolio Variance?

Article - What is Jensen´s Measure (Alpha), and How is it Calculated?#Nasdaq #DAX #HSI #saopaulo

Dheeraj on X: Portfolio Variance (formula, example) How to Calculate Portfolio Variance? #PortfolioVariance / X

Standard Deviation and Variance of a Portfolio - Finance Train

05. Tutorial 3 course work for statements - Financial Accounting BAC NAME: DILMI MELISHA ID- Baahar - Studocu

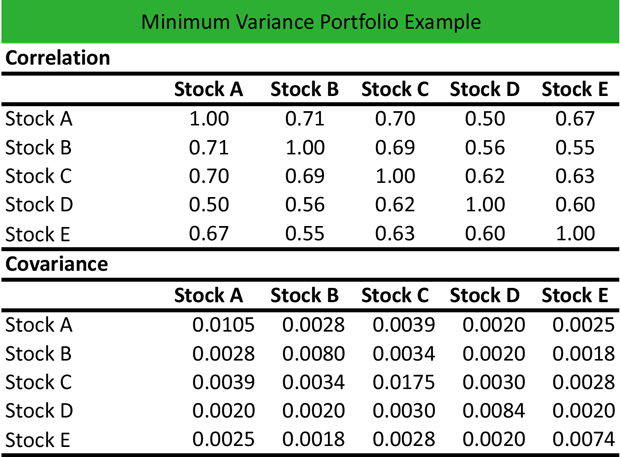

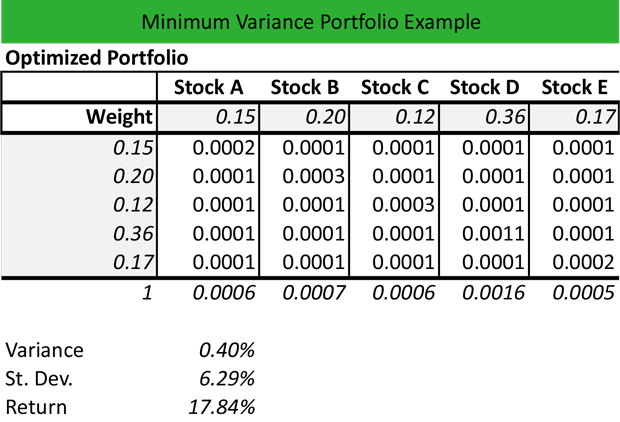

Covariance, correlation & beta examples

05. Tutorial 3 course work for statements - Financial Accounting BAC NAME: DILMI MELISHA ID- Baahar - Studocu

Portfolio, chess engine

finance - Portfolio Variance - Explanation for equation : Investments by Zvi Bodie - Quantitative Finance Stack Exchange

What is Minimum Variance Portfolio? - Definition, Meaning

DECOMPOSITION OF THE VARIANCE OF THE UNHEDGED EQUALLY WEIGHTED PORTFOLIO

:max_bytes(150000):strip_icc()/GettyImages-11707409691-57a69e39b23448f8b091d8c355b9d0ad.jpg)

Post-Modern Portfolio Theory (PMPT): What it is, How it Works

FIN330 - Notes - Capital Structure Theory Trade Off Theory ○ Debt level are chosen to balance - Studocu

What is Minimum Variance Portfolio? - Definition, Meaning

Modeling Portfolio Variance in Excel – Riskprep